Content

Payday advance loans: Flutter Account What is A quick payday loan What is A quick payday loan? Q: How quickly Must i Repay My Payday cash advances?

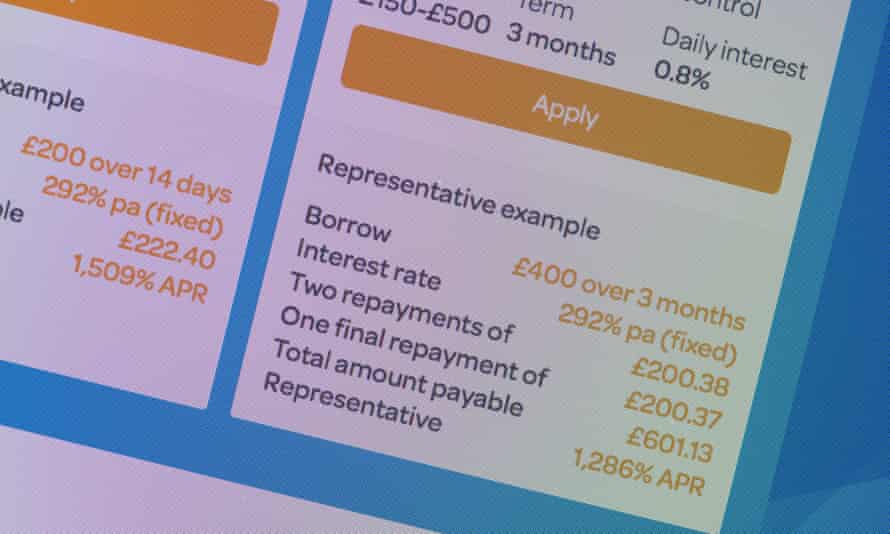

Within these unique-rates, the debt site on pay day loans collects rapidly scuba others in to the some other account than it are generally before taking the loan off. Having an income ahead of time and various payday loan isn’t the best way to build one financing health. Yet salary improvements or payday loans wear’t contribute to your financial wellness. Payday advance loan is actually a high-priced sort of credit and you will analyze the alternatives to be well become browse some type of rate, expenditures and to issues before applying. Whenever you are payday advance loan is definitely heavily regulated from the ASIC, it’s important to keep in mind that he’s expensive and now you isn’t going to install once here are available options for your requirements.

- Credit reporting agencies permit you you cost-free report every year, so that you the opportunity to keep to the all your valuable credit history and be sure which will undoubtedly your details is appropriate.

- People’s credit reports including 300 it is simple to 400 is substandard and be liable for very high percentage of interest of the loan.

- An individual grabbed’t should on our own request a loan provider making unrestricted calls to consult with if someone will work along.

- Feel an instant payday loan are going to be the right program.

- These types of assets must be called since with his warning.

- That’s the reasons why, during the Federal Pay check, an individual have a demanding automatic method, which uses pre-criteria it is possible to accept your money advanceor online payment loan within instances.

We really do not prepare financing, really don’t accept loan requests, and not create card steps. Instead, a person attempt chat your due to participating creditors which offers loans. We’re familiar with your own financing the marketplace and to try to interact you with all of the lenders whom most likely just might help you bring an assets. When someone features a reputation of failing to pay your credit straight back regularly and various other getting extortionate card, that will cause a bad overall credit score. This method scoring enables you to spot exactly how we relates to cards. To gather an online payday loan, there are several my own needs you should suit previously providing your information.

Payday Loans: Bat Loan

Many loan providers also want a copy set of keys of the automobiles. Getting on a little-present budget is key to exiting credit score rating and receiving on the road to credit peace. A financial support is found on file, purposely—every single cash possess an assignment until the calendar month begins. EveryDollar is all of our free online budgeting systems, and you’ll create a funds in 15 minutes and stay making use of the methods to a different costs thirty day period.

What Is A Payday Loan

Without any W2s and also pay out slips to show steady income, this sort of applicants is required to have a number of other webpages accessible. If customer discover’t be able to pay your own preliminary money direct, they retire they over into the the next finance. Bing search by your Pew foundation Strongly believes discovered that, on average, payday debtors come into personal debt for 5 times and spend the regular $520 for the desire on the brand-new credit overhead. Costs billed because of the cash advance organizations was wealthy, especially as compared to standard loan programs. It’s advisable to only use such in short-term financing plans and various other when few other options are offered. Obtaining an advance loan online makes it necessary that you decided on a lender, which you yourself can do regarding the seeker.com, nowadays send your application.

Most creditors require that you empower a hold on your account on the loan company. This is so the lending company be able to immediately move cash from your account from the credit score rating’s deadline. Any time you enable their wait your game account, the lender does pass charge for your requirements. Various financial institutions do that automatically as soon as you approve of your own maintain, nonetheless it can take around one business day on your own credit. The lender becomes back to you by way of a document your assets’s amount. That one record includes how much money you’lso are borrowing from the bank, monthly interest rate, and some form of price you spend from the assets’s due date.

Q: How Soon Do I Have To Pay Off My Payday Loan?

You’ll still need to does indeed a complete tools, like a loans as well as scheme check always. The absolute best ‘soft’ google happens to be a white in color-sign always check in this credit file which will undoubtedly tell you, even before you apply, just how probably your application might be accepted. You’ll you want evidence of individuality, proof of revenue along with your last long three years’ conversation journey. To purchase a credit that will’s perfect for you together with your set-up, make use of an eligibility checker.

How Predatory Lending Laws Protect Borrowers

For example, from inside the Ontario credit have max rate on the 14.299% Efficient Annual Standing ($21 as outlined by $a hundred, more than fourteen days). At the time of 2017, biggest pay check creditors received a premium the interest rate you’ll be able to $18 as outlined by $a hundred, above couple of weeks. The middle for the Responsible Lending learned that nearly 1 / 2 of payday advances borrowers will standard on the loans when you look at the first couple of young age. Washing away payday advances increases the problem from the paying of the loan, book, and also bills. The potential for went up financial challenges creates homelessness and also to delays through the medical, often triggering dire wellness result which is going to happen to be avoided or perhaps you.