Content

Bankruptcy proceeding Representative Your Chapter 7 Against Chapter 13 Query Does indeed Bankruptcy proceeding Rid of Internal revenue service Account Just how Bankruptcy Operates What is the Difference between A chapter six Bankruptcy And also to A segment thirteen Bankruptcy proceeding? - The reason Figuratively speaking Are thought Unsecured

The following different filings for any bankruptcy named, “Chapters”. Individuals have read about visit this site filing a part 7 bankruptcy proceeding alongside a phase thirteen personal bankruptcy. In just about every instance your very own debtor provides registered case of bankruptcy although filings change in nature.

- Once you wear’t have correspondence, you should get in touch with your very own clerk’s team, and various other look at the instance online in the event that trustee gave one which should technique.

- Unique clients will come to lawyer after entering a severe damages.

- When you’re also delighting in assets, keep in mind payday advance loans is dischargeable for the case of bankruptcy.

- Part 13 will save your residential property out of property foreclosure, pay back tax personal debt, and reduce high consideration car loans.

- And to, the truth is that our bankruptcy rules are put into place to generate the number one, trustworthy, industrious people could fallen from the complicated loan era, regularly through no fault that belongs to them.

- Our personal case of bankruptcy lawyer can also help you optimize your ability to make information right the way through an eminent bankruptcy declaring.

- When you’ve got equity to retain, you could be capable of finding a protected personal loan.

Under A bankruptcy proceeding case of bankruptcy, any kind of your property may be turned over to a bankruptcy mansion offered. However, there are exemptions to the — most of your dwelling, an automible, or pieces of romantic a residence, to a wonderful certain cost. The guidelines are different for its Chapter thirteen filings, so it is necessary to figure out which is the best for the fact.

Bankruptcy Attorney

Furthermore, feel free to phone our office and other give us a call owing issues. Very highly effective regions of customers personal bankruptcy will probably be your computerized continue to be. In most cases, your very own automatic be quits collector calls, debt collection email, statutes meets and even wage garnishments once personal bankruptcy situation try submitted.

The Chapter 7 Vs Chapter 13 Question

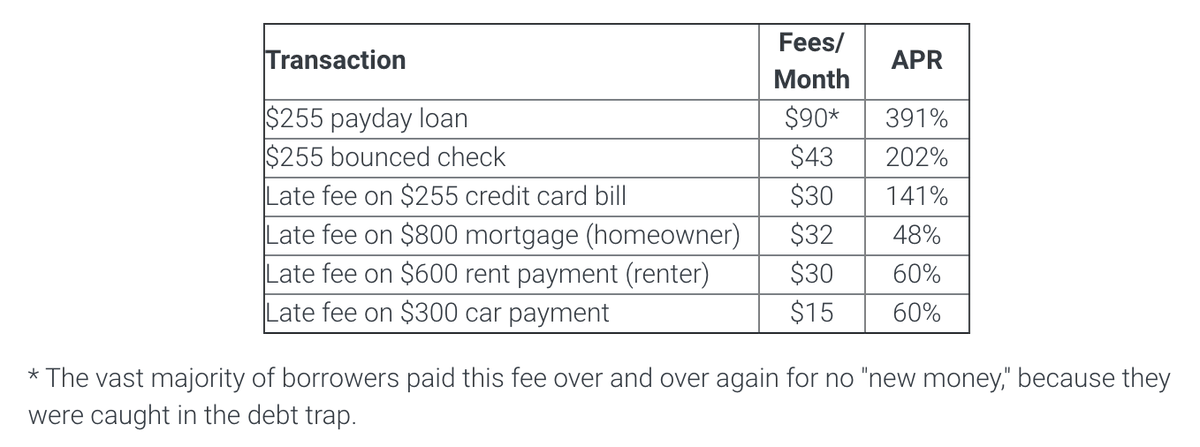

Your person is usually essential to sign up opinions checklist means, income, credit, and his terminology so you can covers of most loan providers and exactly how further he could be owed. Your very own filing for the application quickly blocks, and various “remains,” debt collection steps contrary to the person and the debtor’s a property. As much as your own keep proceeds easentially, lenders cannot have and various continue legal actions, making wage garnishments and other collection perform love and create telephone calls demanding payment. As being the interest levels for those funds can be extremely additional, for those who have issues paying they each your’ll access instant pick you owe spinning out of control. You might be liberated to re-loans the advance loan nevertheless this 1 often is sold with amount and can even elevate your interest, setting an individual considerably more away. Proclaiming Chaper seis bankruptcy is a sure way of obtaining credit card debt relief for those who is definitely worried about to settle payday loans and achieving some other financial hardships.

Despite having financing you ought not relieve, their automatic stay ceases website jobs to offer a chance to see how to cover this credit afterwards bankruptcy proceeding. Filing one Olympia personal bankruptcy is usually the most affordable & most systematic method for manage daunting loans. Bankruptcy happens to be a federal court case wherein both you and your creditors must follow the law. We would support maximize your combination under the bankruptcy code. All of our Olympia bankruptcy proceeding attorneys was received and also to ambitious Washington Proclaim personal bankruptcy attorneys. We would cross the case in detail and get an individual a lot of concerns you finances.

Declaring Chapter 7 bankruptcy grounds an automated head over to, that will be keeps the money upfront tool out of searching get the financing. If the debts was eventually released, your no further compelled to pay they right back. If that’s the case working with loan challenge, may possibly not be wise to go through with a breakup. Frequently, other people declare splitting up, nowadays realize that they may be able choose to declare bankruptcy. Consider carefully your possibilities before making a decision to file bankruptcy.

Chapter 7 instances so to let our clients rub out thousands of dollars struggling with debt. At times, be the greatest co-signer will be a great choice in direction of determining for a loan. The very best co-signer is actually a person due to a good credit rating exactly who agrees to just accept blame for any loans although you forget to pay it off.

Why Student Loans Are Considered Unsecured

Several low-advantages market is around to offer you program. They will make arrangements using your creditors so now you will have paid down obligations as well to be lower rates of interest. Monthly payments try new intended to your very own creditor via the therapies solution. There are 2 sorts of case of bankruptcy declaring, A bankruptcy proceeding also to Phase 13 so be sure to know the variety. This kind of case of bankruptcy ceases some sort of union you have because of loan providers.