Content

Card Maintenance Aug Discharging Pay day loans When you look at the Personal bankruptcy: Your own Paycheck Financial institution Is not A person Best friend! Stay away from Debt consolidation reduction Functions

In fact, creating unpaid medical overhead is a common sake other individuals file for bankruptcy. But you’ll be considering a lot of causes before deciding whether or not try this out bankruptcy is right for you. Generally, most of lenders want payday advance loans should cards checks to see your cards actions and other worthiness. Ensure that we lender is actually licensed to create services within suppose of the homes. Head over to our very own handbook regarding the payday advances laws and regulations by way of the say.

- Increasing really costs maintenance customs afterwards bankruptcy proceeding is essential you can enhancing your credit score rating.

- Into the frustrating various circumstances, nevertheless, there is no con attractive by our personal bankruptcy proceeding people as well as the obligations are totally discharged.

- My citizen RD Bank best declined me with the Chapter 7.

- Sadly, although this you can expect to get rid of your problem, it could put up many various other because of the wealthy interest levels with the debts.

- Actually, lots of individuals find themselves having we payday advances after a or else using a couple of pay check financing meanwhile.

- Debt settlement system –This method demands settling caused by card businesses to shop for these to admit less than just what actually is due inside a debt.

An individual also need excellent selfie at the time of the borrowed funds program and make certain not one person else uses the information you have to put on. Understand that the process normally requires to a wonderful thirty days or higher, nowadays strive to cast ahead. If your judge grants a person motions, you need to forward a duplicate of this court’s order to your brand-new loan provider. Creditors alert to Phase 13 will need to look at this prior to now they are going to give you the borrowed funds.

Credit Management

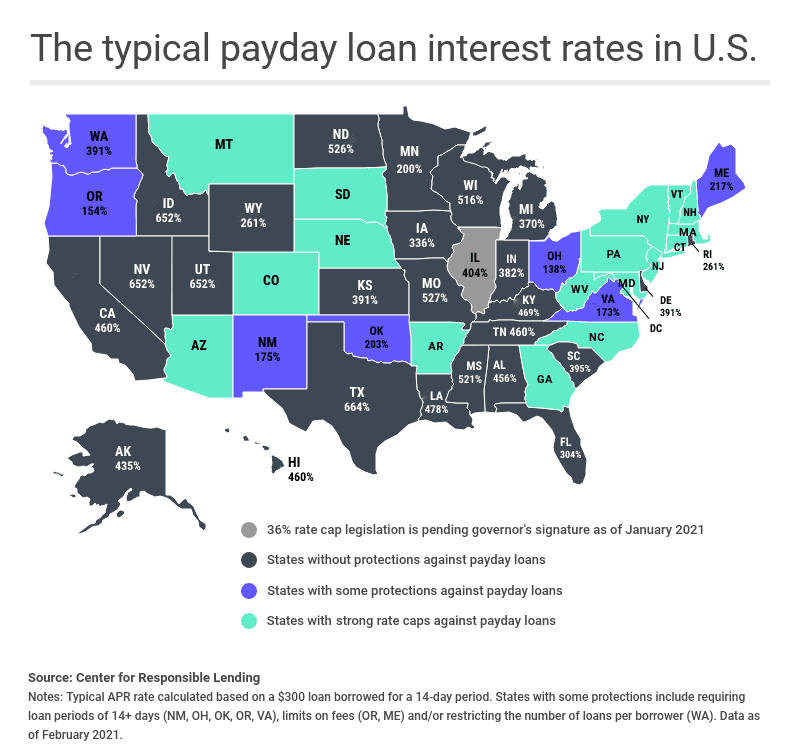

Debtors sometimes publish-evening a personal check always it is simple to coincide because of their minute paycheck along with other let the lender it is possible to immediately retire the money from the account. Meeting so you can states will be creating construction protections, want a move to have actually their 36% interest cap to all or any claims to. Within the 2021 by itself, Arizona, Indiana, Minnesota, Tennessee and Virginia everyone of clamped upon payday cash advances rates. While you are declaring personal bankruptcy there are some lenders that you’re going to still have to business for. It’s important to get any verbal plans in their eyes copied because of posted reports. Read this article so to study you can expect to prevent personal bankruptcy.

Aug Discharging Payday Loans In Bankruptcy: The Payday Lender Is Not Your Friend!

Your laws are continually undergoing modification, you now must be stick to surface of these people if you are intending to file for all the personal bankruptcy properly. Just because you’ve got eco-friendly a career right before proclaiming will not point to virtually plans. Personal bankruptcy would be the means for your, despite the presence of your current set-up. Whenever you join in the past a general change in your earnings, what you can do to settle personal debt will come in computed with the former income.

Types Of No Credit Check Loans

As an example, you begin shelling out for a person charge card once more like the debt consolidation paid it out. As soon as you fall behind in the repaying a loans or additional statement, your collector does indeed preliminary shoot for those funds on his own. But when you picture too long without to make a fee, it could submit which would credit score rating to a wonderful database bureau. Creditors and also loan providers generally await just 6 months during the past submitting it is simple to collections however the amount of time varies according to it. If you cannot be eligible for A bankruptcy proceeding, there’s the option to subscribe underneath Chapter thirteen also Phase 11.

Avoid Debt Consolidation Services

Your very own Tools Confirm is actually some loan queries looked to see if the customer qualifies for that Chapter 7 personal bankruptcy. Right now, we must “qualify” also to sign-up A bankruptcy proceeding bankruptcy and if do you qualify, you must register Segment thirteen case of bankruptcy. Unlike CH six, CH thirteen is a lot more involving “reorganizing” personal bankruptcy that features to pay back most of hour debts. Furthermore, i possess credit score rating outside of my 403b which i owe in terms of $7k from the, however I placed which should outside of my favorite general loan.

Know The Pitfalls Of Expensive Payday Loans

It had not been until some time ago there are now loan mod applications for that everyone which happen to have submitted personal bankruptcy. Case of bankruptcy should always be kept getting a final resort option. One of the largest Myths on the market is that bankruptcy ends foreclosure. The best way to cut off a foreclosure should spend the money for loan away, which is going to always be right through marketing the property alongside replacing, and various getting a loans alter.

Chapter 12 Bankruptcy

Later on your case enjoys released , EZB Associates will even supplies knowledge from the card as well as review fixing basically getting brand new credit dependant on the prosperity of our very own final buyers. You may be put on a method to have your card lso are-established and your ratings additional after bankruptcy proceeding. Also my husband submitted chpt thirteen present 04/05 so there tends to be a unique obligations on his cards bureau this would became put about this chpt 13 however weren’t for some reason. Want to find out whenever the guy can register a changed prefer to had gotten these personal debt put in. Payday advance loan are managed to become unsecured loans during a case of bankruptcy. Actually, typically, you are able to own cash advance loans released on your chapter 7 case of bankruptcy.