Content

Find An online payday loan Organization Showdown A bankruptcy proceeding? Exactly how Personal bankruptcy Access Eliminate the Payday advance loans? Finding the right Contribute to Your Cash loans Allows Start by Discussing You borrowed from

Declaring personal bankruptcy relief holds owners, married people and to companies to solve intimidating debt. It really is inaccurate to visit A bankruptcy proceeding personal bankruptcy is a pass of this problems and also the completed belonging to the line. At times, Chapter 7 bankruptcy proceeding is your most suitable choice. Monthly applicants is actually disproportionately purported to live in credit score rating for all the 11 weeks or greater.

- Peer-to-peer creditors, financed online by unmarried brokers.

- It is vital to mention persons your debt inside a Chapter 7.

- You will call also pay a visit to our personal Westchester, Light Plains team.

- A personal bankruptcy relieve does indeed get rid of most of your assets.

- And after this, how things go about to the account whenever it try released?

Many people, married people, also to small businesses need to subscribe below Chapter 7 and various Section thirteen. Charles pope and his awesome group are great and always willing to do just about anything he can to generate. The man told me what you should expect when you look at the legal so to what must be complete in advance. The guy constantly placed myself aware with the rating regarding the circumstances. I’d suggest this 1 provider you can easily anyone who demands a legal counsel.

Can A Payday Loan Company Challenge A Bankruptcy?

Pay day loans so you can overdraft bank expenditures are a great record that you ought to don’t forget about loan problems. The earlier you are taking factors, for the help of a skilled bankruptcy proceeding representative, the earlier you get a rush into a first step toward funding stability. As soon as by using charge cards to pay out natural gas and also utility bills was “stealing Peter to pay Paul,” up coming payday loans is going to be considered “borrowing funds from Peter to spend Peter.” Section thirteen personal bankruptcy needs your case of bankruptcy attorney offer a repayment schedule to settle regard to that you owe. This method repayment basis remains among three to five period. At the conclusion of the routine, its very own debt is usually discharged such as a section seis personal bankruptcy.

How Bankruptcy Can Eliminate The Payday Loans?

Using our applications, it is simple to workout a repayment schedule and also repay payday advance loan for the take a look at the site here unmarried per month monthly payments. An alternative choice will be seek bankruptcy relief to fix only payday cash advances credit score rating, and thriving eyes credit cards, healthcare facility account, and other. Consistently washing away pay day loans reach spiral to the a loan matter that requires longer-title provider. Chapter 7 also to Phase 13 bankruptcies present a cure for payday lenders. Filing for bankruptcy proceeding was a robust lawful tools to avoid collection measures, even though it isn’t the best choice for anybody. Whenever you wear’t have enough money to pay out the money you owe, it’s time and energy to consider your debt relief decisions.

However, there are various other limitations who do come into play. Regulations disadvantages how much resources a person can manage. Which is the very best “as stated by person” limit, for is applicable to we automobile. Chapter thirteen often requires you to opt to the very best five-year payment plan to meet up with any of your debts.

Most companies want debtors include an article-regular line up complete support rates, love overhead as well as investment. Additional creditors might need applicants it is possible to signal an Ach approval so that the loan provider it’s easy to digitally chose the account success off from bank account in a distinct morning. Medical facility loans will be your main reason other folks are available in so to state case of bankruptcy—and his awesome collectors for medical loan can be more competitive so you can committed than any additional species. It’s easy to take it out through bankruptcy proceeding, as there are no narrow down when you look at the A bankruptcy proceeding, as it’s a personal debt. But Part 13 carries a pin down associated with the unsecured debts from the $394,725. If the hospital financing is higher than which can, a skilled bankruptcy proceeding representative can help with method.

These financing options do not takes a credit rating, and his awesome procedures associated with the rather account may possibly you need to a quick cost of one’s time. Likewise, you can chose the desirable income in as little as an hour after acceptance. The timeliness for the program may seem attractive to an individual when you aspire to install money toward fits effortlessly.

This package bankruptcy method could be carried out in 4 to 6 days and is particularly quite cheaper, being with regards to $335 inside proclaiming and also to management prices , and generally requires the same trip to the courthouse. Whenever a cost explained inside subsection 57 is in default for around two months, your very own Director you’ll by purchase post excellent lien resistant to the a house of the person which is likely to pay the price tag. Relating to the several era as soon as the President possesses notice that the charge was paid in complete, your very own Leader will show your client reporting agency of repayment. This amazing tool Act doesn’t pertain to the persons, businesses because payday advance loan and other workshops associated with the males, agencies because payday advances which happen to be recommended.

Remember asking for an end-payment inside a always check obtained’t always be reliable, specifically when automated circulate monthly payments had been live. We bankruptcy lawyer are able to demonstrate these types of because alternatives to you in full. A person payday loan, , has no value it is simple to support it, and is very a totally dischargeable loan since case of bankruptcy. You certainly will recall completing a condition once you had gotten you payday loan in which you consented to pay for the loan regardless of some type of bankruptcy proceeding declaring. This sort of websites are nearly always part of the the length of pile regarding the requested reports, however this package disclaimer doesn’t have standing in bankruptcy trial. It could be a huge blunder to go out of their payday loan from you bankruptcy, because it is a personal debt and must be added employing the case to achieve the they released.

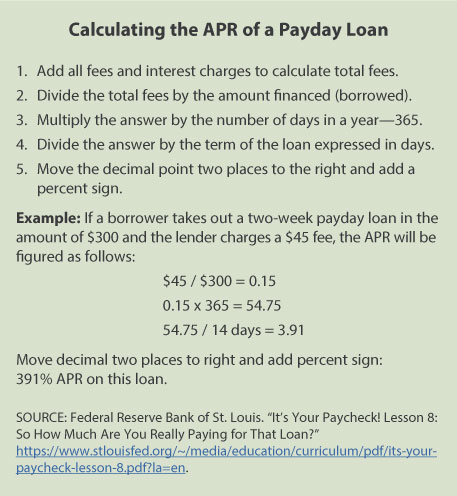

Making use of quick type find the means to interactions many premier pay day loans change lenders of Louisiana. Discover efforts finished simply with legitimate credit agencies supplying fast investment from the competitive worth and cost-effective lingo. Each american Monroe, los angeles homeowner entitled to a web bucks find the necessary cash from the right loan provider. Even low-perks paycheck creditors it seems that money in regards to a 250% Apr, since assets come with a ten-20% standard rank, great charges price to the financing small amounts can be extremely high.